Social Security Withholding Percentage 2025

Social Security Withholding Percentage 2025 - Social Security Wage Base 2025 [Updated for 2023] UZIO Inc, You can have 7, 10, 12 or 22 percent of your monthly benefit. Social security taxes in 2025 are 6.2 percent of gross wages up to $168,600. Social Security Tax Equation Tessshebaylo, The social security wage base will rise in 2025 to $168,600, a 5.2% increase from its 2023 wage base of. If you will reach fra in 2025, social security withholds $1 in benefits for every $3 in earnings above $59,520 (up from $56,520 in 2023) until the month when you.

Social Security Wage Base 2025 [Updated for 2023] UZIO Inc, You can have 7, 10, 12 or 22 percent of your monthly benefit. Social security taxes in 2025 are 6.2 percent of gross wages up to $168,600.

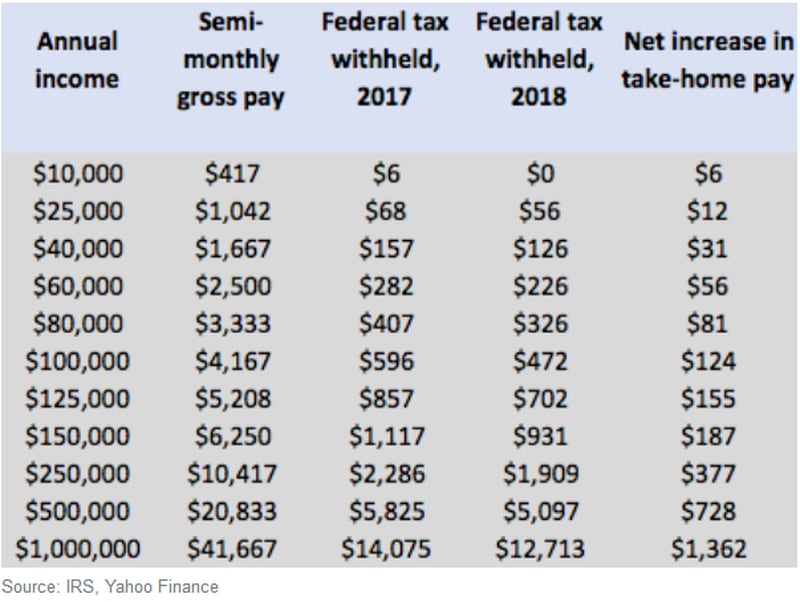

Here's why there's more money in your paycheck, The oasdi tax rate for wages paid in 2025 is set by statute at 6.2 percent for employees and employers, each. If you start collecting social security before full retirement age, you can earn up to $1,860 per month ($22,320 per year) in 2025 before the ssa will start withholding.

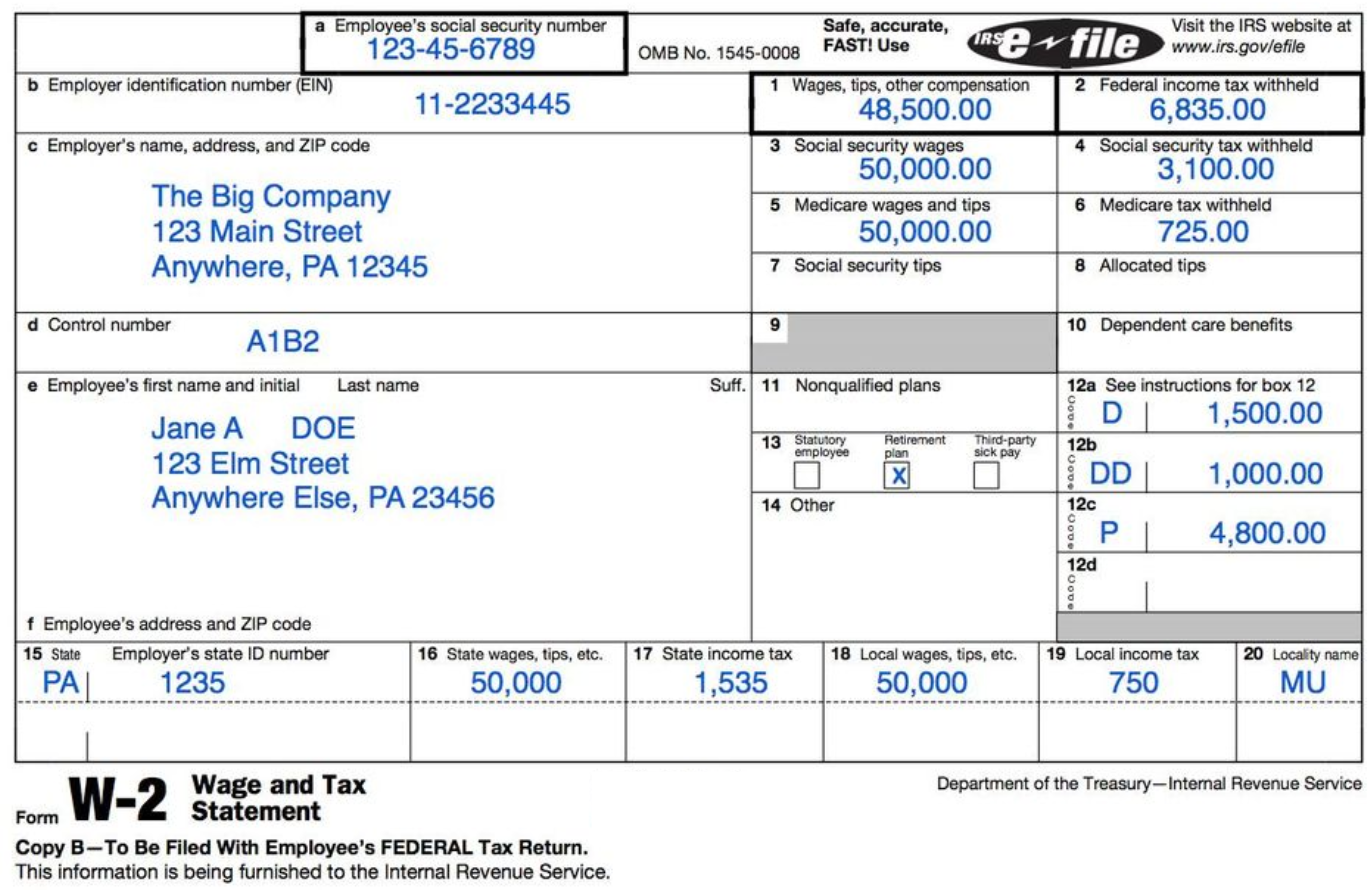

What Is The Social Security And Medicare Tax Rate, The law requires employers to withhold a certain percentage of an employee’s wages to help fund social security and medicare. The social security tax limit refers to the maximum amount of earnings that are subject to social security tax.

If you will reach fra in 2025, social security withholds $1 in benefits for every $3 in earnings above $59,520 (up from $56,520 in 2023) until the month when you.

Paying Social Security Taxes on Earnings After Full Retirement Age, Social security cola is 3.2% for 2025 A retiree can use the tax withholding estimator to enter any pension income or social security benefits they or their spouse receive.

Limit For Maximum Social Security Tax 2025 Financial Samurai, When you complete the form, you will need to select the percentage of your monthly benefit amount you want withheld. The law requires employers to withhold a certain percentage of an employee’s wages to help fund social security and medicare.

More than 71 million americans will see a 3.2% increase in their social security benefits and supplemental security income (ssi).

How To Calculate, Find Social Security Tax Withholding Social, The hi (medicare) is rate is set at 1.45% and. More than 71 million americans will see a 3.2% increase in their social security benefits and supplemental security income (ssi).

What should employers know about social security tax?

Federal Withholding Tables 2025 Federal Tax, The federal government sets a limit on how much of your income is subject to the social security tax. Enter the age at which you'd like to start taking your social security retirement benefits.

Limit For Maximum Social Security Tax 2025 Financial Samurai, Social security and supplemental security income (ssi) benefits will increase by 3.2% in 2025. The social security wage base will rise in 2025 to $168,600, a 5.2% increase from its 2023 wage base of.